The Revenue Fallacy – and What to Chase Instead

Most consultants have this fantasy: make a boatload of money, maybe buy a slightly unnecessary car, and finally kick back while your business “runs itself.”

This is a “nice” dream, but it ignores the reality that the truly wealthy understand better than anyone else:

Revenue alone doesn’t buy freedom. Equity does.

Revenue can pay your bills. It can’t buy back your time.

It can cover your costs. It won’t secure your future.

It can fill your cash accounts now. It won’t stop you from hitting that “start over” button every. single. month.

Financial freedom, the kind that lets you choose when and how you work, is built on something deeper. It’s built on ownership, assets, and equity that compounds while you sleep.

If you’re stuck on the hamster wheel of income-based hustle, it’s time for a hard pivot. Because no matter how much money you make, if you’re not stacking equity, you’re just a high-paid employee of your own business.

There’s a blueprint to this. Let’s break it down.

The 4 Levels of Financial Growth

Let’s break down the journey from “I work for money” to “money works for me.” Then we’ll get into some nitty gritty, tactical stuff that will help you skip levels. If you’ve hung out around our community for a while, a lot of this part will sound familiar.

Level 1: Earner

You trade time for money. Congrats, you’ve got a job… in your own company. You’re the rainmaker, the fulfillment team… and sometimes the janitor.

Level 2: Leverage

You start building systems and teams. You’re still involved, but now your time isn’t the bottleneck. You’re stepping into ownership, not just operation.

Level 3: Multiplier

Here, equity starts to bloom. You own things, be they businesses, IP, assets, or whatever else. They generate wealth with or without your daily input. This is where the compounding starts.

Level 4: Investor

You’re out of the weeds. Your assets produce yield. Your lifestyle is funded by dividends, distributions, and profit shares. The business can be sold, held, or passed down. You don’t have to work unless you want to.

(For additional thoughts on this, don’t miss: Earner Vs Owner: Three Foundations of a Long-Term Wealth System. It’s a good read that will clear up some of the finer points here.)

Cash Maximums vs Minimums: Stop Hoarding, Start Deploying

Okay. Before we get into the tactical training, let’s set the table. To understand equity and healthy business finance, we have to first understand cash.

When we say “cash,” we’re talking about liquidity. Real money that you have direct access to. Not assets or credit lines.

The number one thing to understand about cash is this: cash should move.

A lot of consultants obsess over cash minimums, or how much runway they need if everything goes sideways. That’s smart. You should have at least 3 to 6 months of non-variable operating expenses in your business. This is your safety net, your “oh crap” fund. As an example, in our business, The Wealthy Consultant, we consistently keep a cash runway of 6+ months on hand, in addition to over a year worth of liquidatable assets (more on that later), at any given time.

But far fewer people talk about cash maximums… And they 100% should. Keeping too much money idle in your business is like hoarding firewood in the rain. It just sits there, getting soggy, losing value by the minute.

Cash (in a vacuum) is unproductive by nature. Its job is to fuel things. So once you’ve hit your safe minimum, the rest should be working for you, not snoozing in your Chase account. Stack it, deploy it, and turn it into equity.

If you’re not sure how to stabilize your business cash flow enough to even think about equity, start with the basics right here: 3 Cash Flow Levers That Bulletproof Your Business.

Creating a Fortress of Freedom

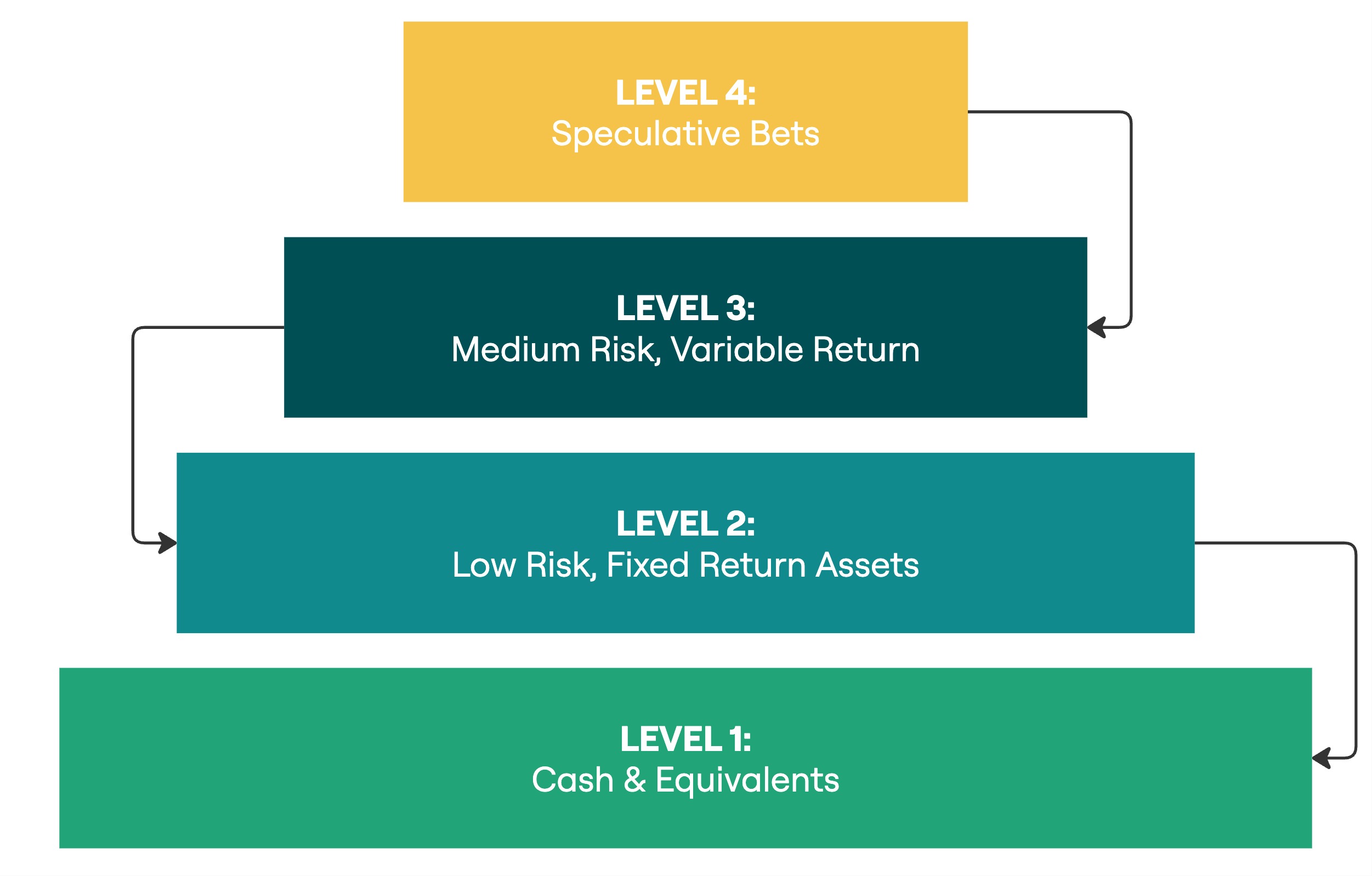

Now that we’ve covered cash, let’s talk about the other side of the scale, which is investments. Picture a pyramid. The kind you’d find on a dollar bill, or in the background of an Illuminati meme (whoops).

That’s your investment strategy.

Level 1: Cash & Equivalents This is your foundation… your moat. Think liquid funds, HELOCs, whole life insurance policies, and credit reserves. These are stable, low-yield assets that keep the lights on, even in stormy weather. These are the BASE of the pyramid.

Level 2: Low-Risk, Fixed Return Assets Debt funds. Real estate with consistent renters. Investments that aren’t sexy, but always show up on time like a Swiss train. You want fewer of these than cash and equivalents, but more than your higher risk investments.

Level 3: Medium Risk, Variable Return Established businesses, index funds, real estate syndications. These give you some flavor without tossing your risk profile off a cliff.

Level 4: Speculative Bets Crypto. Startups. That “sure thing” your friend’s cousin is launching next quarter. Tiny slice of your portfolio, big potential upside (or not – hence them being the smallest portion of your strategy).

Your financial positions should mirror this pyramid. Heavier at the base, lighter at the top. Let the solid stuff carry the weight. If your portfolio looks like a Vegas weekend instead of an ancient monument, it’s time to rethink your allocation.

For a deeper dive into how business owners should think about wealth strategy, check out this podcast: Financial Planning and Wealth Strategies for Business Owners.

Don’t Just Earn. Multiply.

If you take one thing from what we just covered, let it be this: Stop optimizing for income. Start optimizing for equity.

Cash flow pays the bills. Equity buys your freedom. When you get obsessed with building ownership, you finally start playing a different game… the one that creates real wealth.

And if you want a no-BS system for doing exactly that?

🔥 Cashflow For Consultants is your fast track.

It’s a full suite of video trainings and templates for generating, tracking, and multiplying cash flow in your business—while laying the foundation for equity and long-term wealth.

Start building your future like a pro. Because if you’re not stacking equity, you’re just renting your time.