Trade-offs and Yield

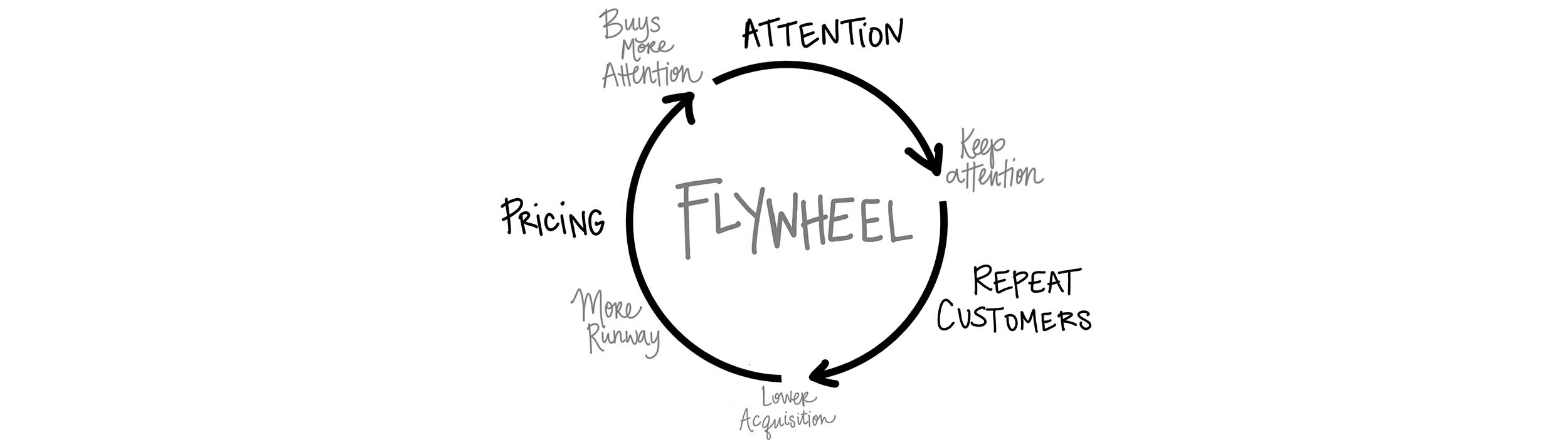

Welcome back, legends! Our goal is to build leverage into our businesses in as many ways as

possible.

When you have leverage, you can grow without the traditional

“trade-offs” most businesses experience. Your “yield” outpaces your inputs.

In this article, we’ll go over three of the leading models we install to create scale via leverage.

The First is Attention – Securing the Eyes and Ears

Attention Retention – Keeping the Trust

Repeat Customers – The Real Business Begins

Cash flow Conversion Cycles – The Strategic Needle Mover

Like this article?