Why More Money Doesn’t Always Mean Better Business

Mistake #1: Platform Concentration Risk

Mistake #2: Product Concentration Risk

Mistake #3: Key Man Concentration Risk

All in All

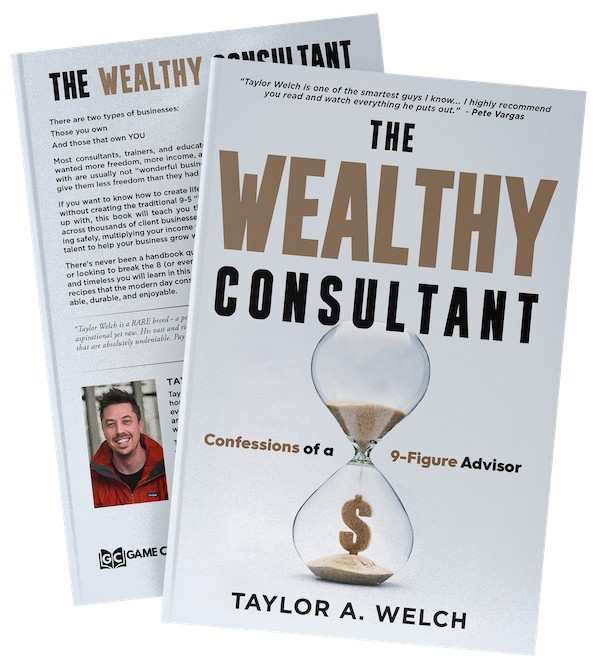

Get Taylor’s Amazon Best-Selling Book Right Now for As Little as 99¢

Taylor’s brand new book, “The Wealthy Consultant: Confessions of a 9-Figure Advisor,” is available right now on Amazon – and the feedback has been unbelievable. Number 1 best-seller in multiple categories! You can get the Kindle version for only 99¢ (physical format also available) today.