Who Do You Sell To Anyway?

You want your coaching or consulting offer to… ya know… make MONEY, right?

Nobody starts an expert business because they dream about being poor, or making roughly the same as they were already making at their full-time job.

Constructing a profitable consulting offer, whether it’s a low ticket front end offer or a high ticket mastermind, starts with nailing 3 components:

- Market

- Solution

- Method

Your Market is your “who” – the demographic and psychographic makeup of the exact person your offer is designed to help.

The Solution is the “outcome” your offer delivers for your market.

The Method is how your offer delivers that outcome.

There’s a lot of nuance in the construction of these things, but we don’t have time to dive into all of the minutiae right now. (We have a book coming out in a few weeks on offer craft that goes a little bit deeper on each of these three components).

Let’s look critically at the first component – your Market.

Selling to the wrong person can be a death sentence for your business (we did an entire article on this, which you can find here). There are both hard costs and opportunity costs linked to marketing to and enrolling people who are not the right fit for your offer.

But how do you tune your marketing and sales processes to attract the right people, and filter out the wrong people?

You can start by creating what we call Ideal Client Profiles (ICPs).

Breaking Down Your ICPs

Ideal Client Profiles are detailed descriptions of a specific “person” (or avatar) that you market and sell your products to. When done correctly, ICPs form a “model” that automates some of your marketing and sales decision making.

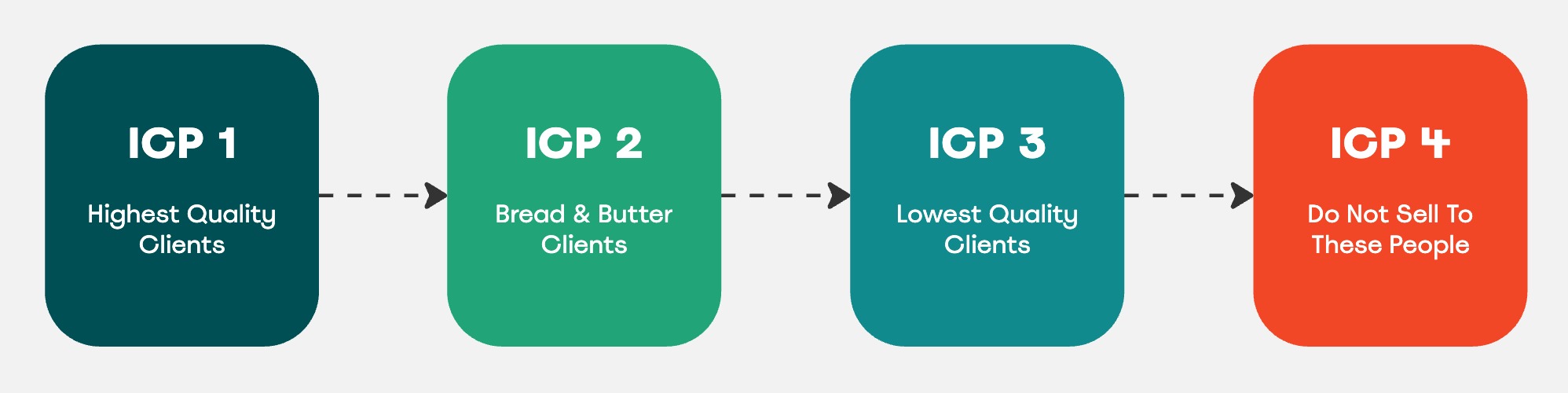

Let us explain – there are 4 ICPs in total.

- ICP 1: Highest Quality Clients

- ICP 2: Bread and Butter Clients

- ICP 3: Lowest Quality Clients

- ICP 4: Do Not Sell To These People

ICP 1 – Highest Quality Clients

ICP 2 – Bread & Butter Clients

ICP 3 – Lowest Quality Clients

ICP 4 – Do Not Sell to These People

Turning ICPs Into a Model

Get 15 Other Models for Scaling Consulting Businesses

Our book, The Wealthy Consultant, has been in the #1 best-seller spot on Amazon for nearly a year – and it’s no mystery as to why! Inside, Taylor breaks down 15 unique models that we’ve used to construct and scale The Wealthy Consultant. You can have a copy shipped to you for just $7.95 by clicking below!