Absent the ‘black swan’ events of the last 36 months, your life (and income) is the eventual result of your net decision-making ability.

Good Decisions – Bad Decisions = Net Decision-Making

Good decisions over a long enough period? Desired level of income, lifestyle, and happiness. Bad decisions over a long enough period? Fall short of desired levels.

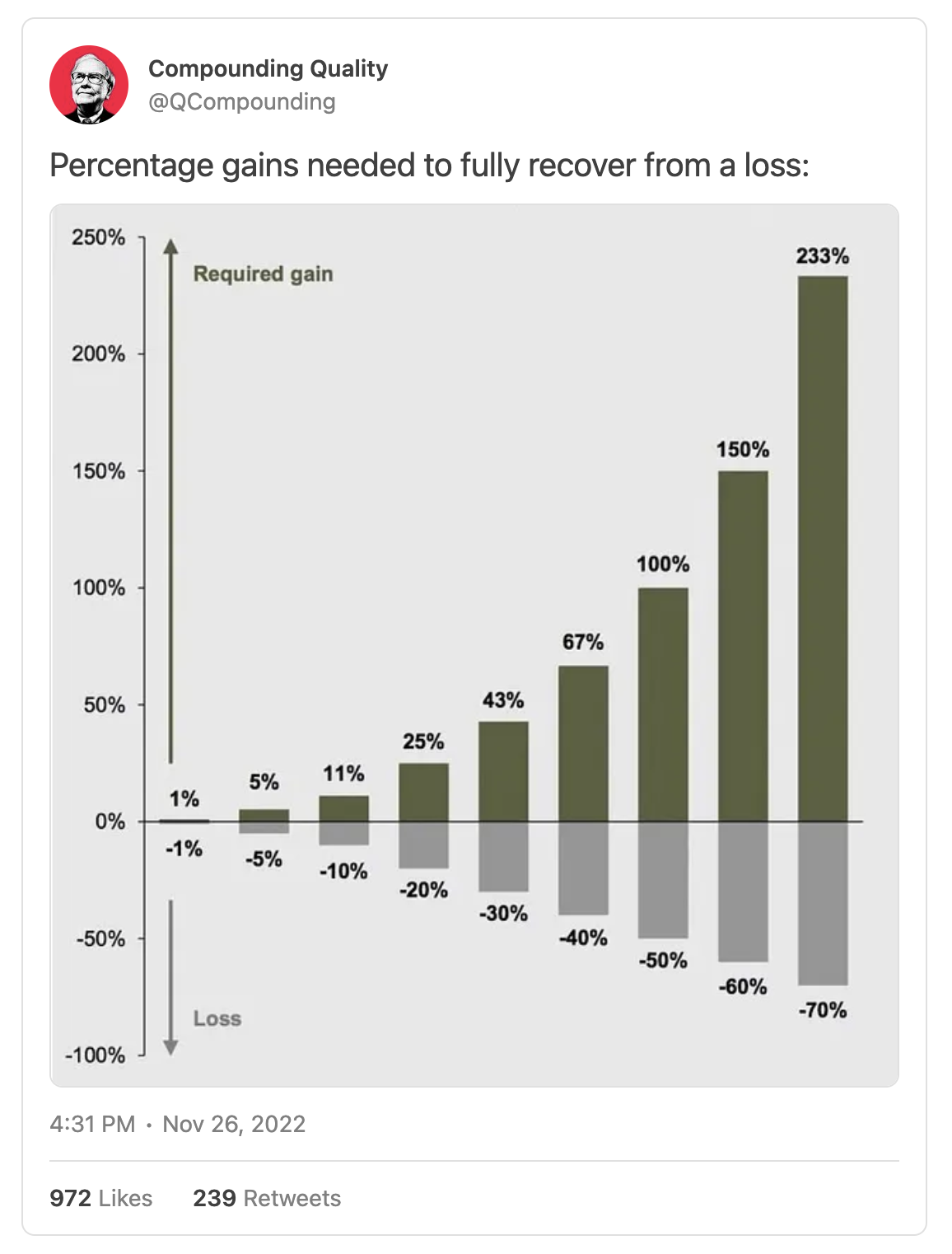

I came across a picture that demonstrates the “recapture” cost associated with bad bets in the markets:

People are used to seeing this sort of thing with financial gains & losses. What they are not used to dealing with, are the mirrored charts reflecting your non-monetary choices.

A parent loses relationship with children because they were “never there.”

A marriage in shambles because one (or both) party refused to pay attention.

A business partnership turns hostile because different values aren’t addressed or reconciled.

If you look back on your life in hindsight, it’s easy to spot the mistakes and the wins. What is fascinatingly difficult, is seeing the signs and making the proper choices, before they branch off into different outcomes.

“Any decision is, in essence, a prediction about the future. When you’re making a decision, your objective is to choose the option that gains you the most ground in achieving your goals, taking into account how much you’re willing to risk. (Or sometimes, if there aren’t any good options, your objective is to choose the option that will cause you to lose the least amount of ground.)” — Annie Duke

Choices are typically a byproduct of the underlying beliefs we have about different building blocks. Your ability to create and compare “probabilities” comes directly from your belief systems.

If you believe someone is bad, you will assign a probability that is slanted in the direction of them doing something harmful.

If you believe we live in scary times, you will assign probabilities to things that are frankly inaccurate and stupid.

Sometimes, the most dangerous belief is that you can control something that you can’t.

Making great decisions requires segmenting things into their two basic categories:

- Things you can control

- Things you can’t control

It is a profound waste of time and effort to mentally rehears & “predict” things you cannot control or change. Take the stock market, for instance.

If you are an investor, you can’t change the price of the things you’re investing in. You cannot materially affect the price of gas or commodities, regardless of how badly you might wish to.

What you can do, is create basic belief systems around what has happened, historically, and what will likely happen based on well constructed patterns of human behavior.

The markets will likely keep going up.

Things are discounted when they’re below average, and they’re overpriced when they’re above average. This is SIMPLE, in theory. But the emotions that come into play make it difficult to think straight when you are afraid (or greedy).

At the end of the day, you must answer one central question:

Did I fulfill my potential with time I was given today?

If the answer is yes? You will be happy.

And it is more probable and likely, if you answer “yes” more days than you answer “no,” that you will achieve everything you hope you will achieve in life.

If the answer is no? Then you have one thing, and one thing only, that you can control:

Make sure the answer tomorrow, is YES.